Trackrecord

MCI trackrecord

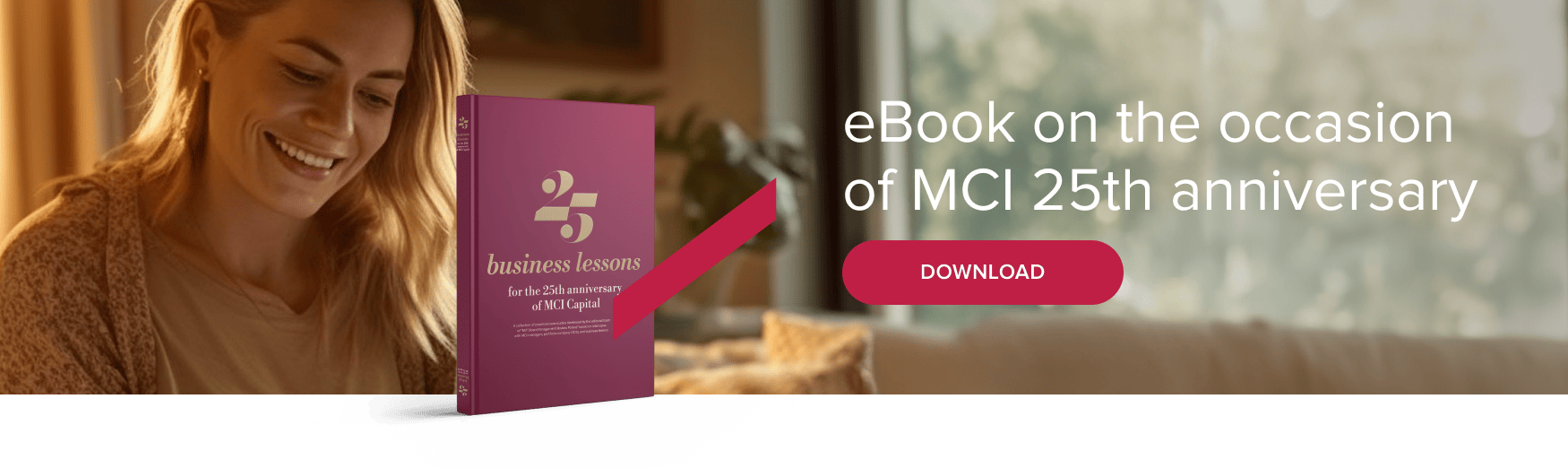

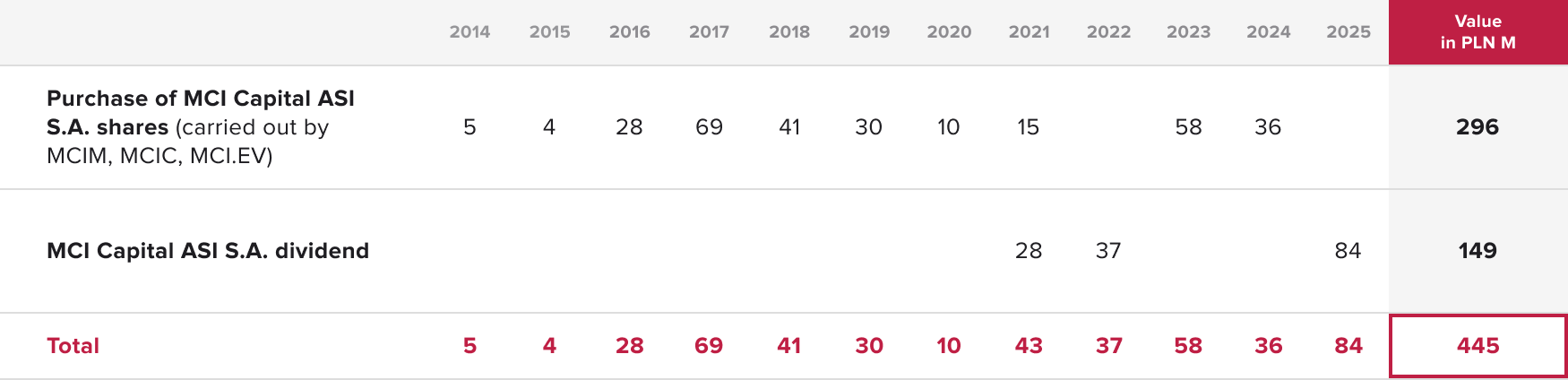

445 mPLN

payments to shareholders

296 mPLN

shares purchase

149 mPLN

dividends

Since 2014 the MCI Group has paid out PLN 445 million to shareholders, including:

- purchase of MCI Capital ASI S.A. shares in the amount of PLN 296 million and

- PLN 149 million in dividends.

Payments to shareholders in particular years were at the following levels:

MCI's historical NAV/S was as follows:

MCI NAV/S [1999 – Q3'2025]

MCI NAV/S [last 12 months]

MCI has achieved a CAGR NAV/S of 16% over the last 25 years (from 1999 to 2025).

25 years

of MCI

16 %

CAGR NAV/S

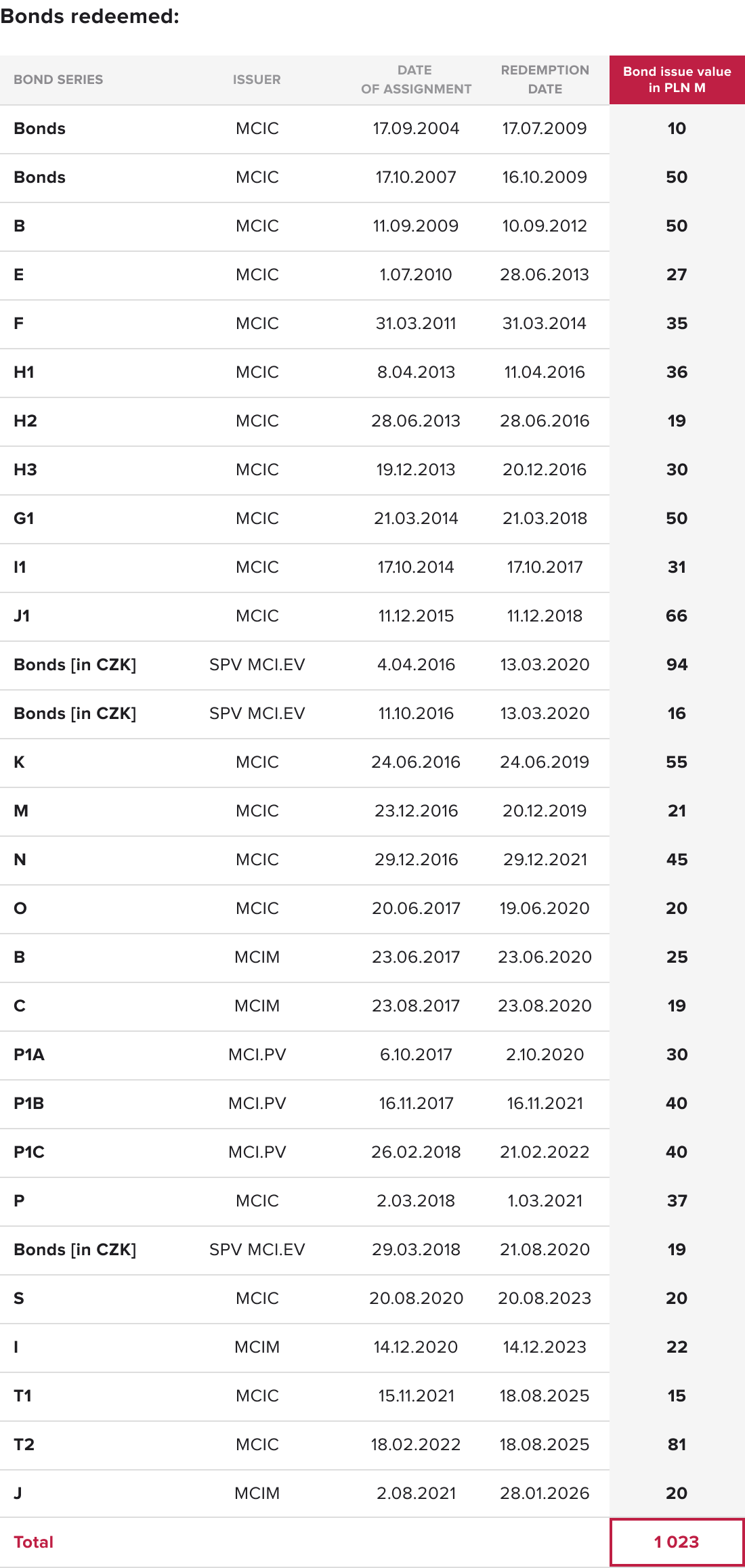

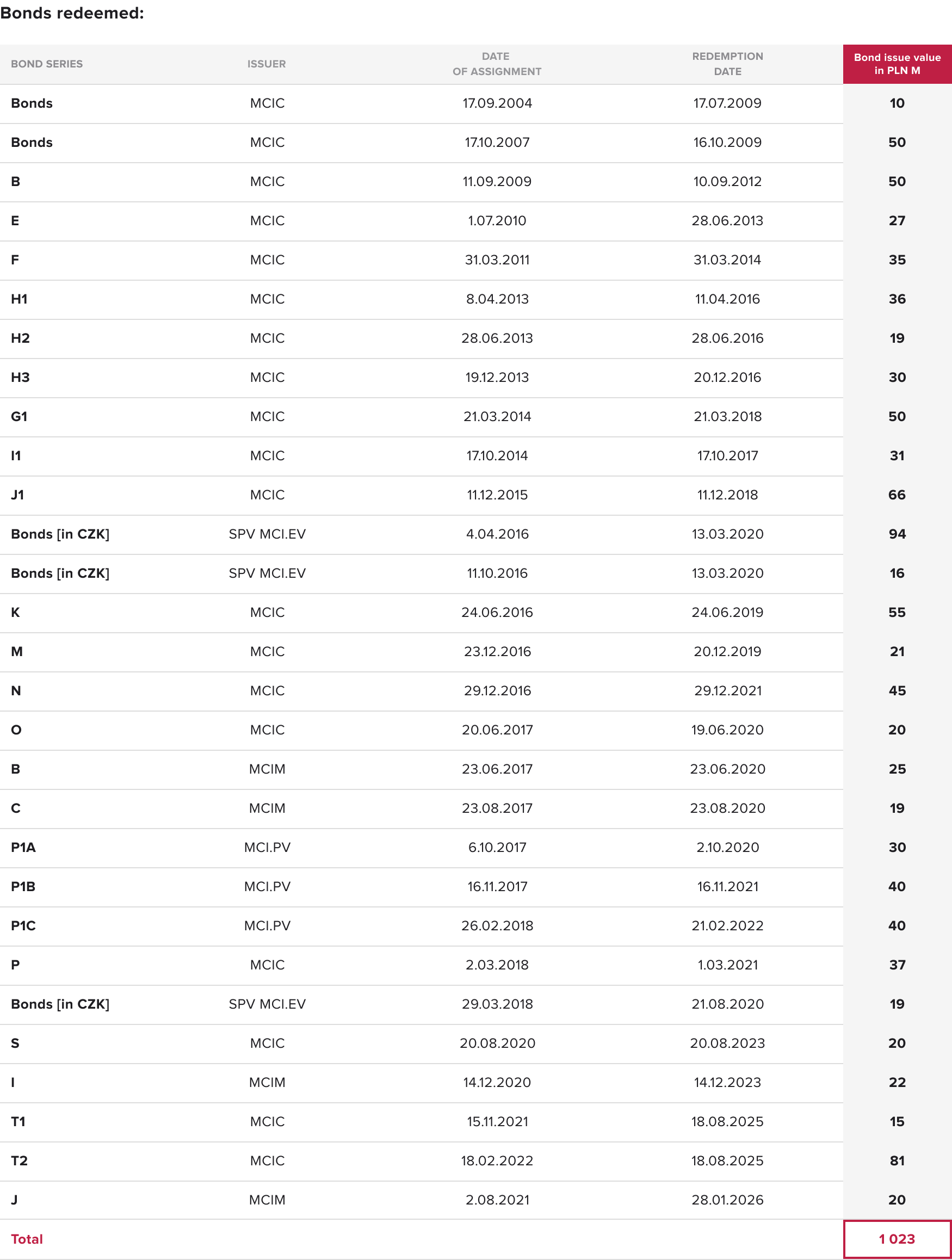

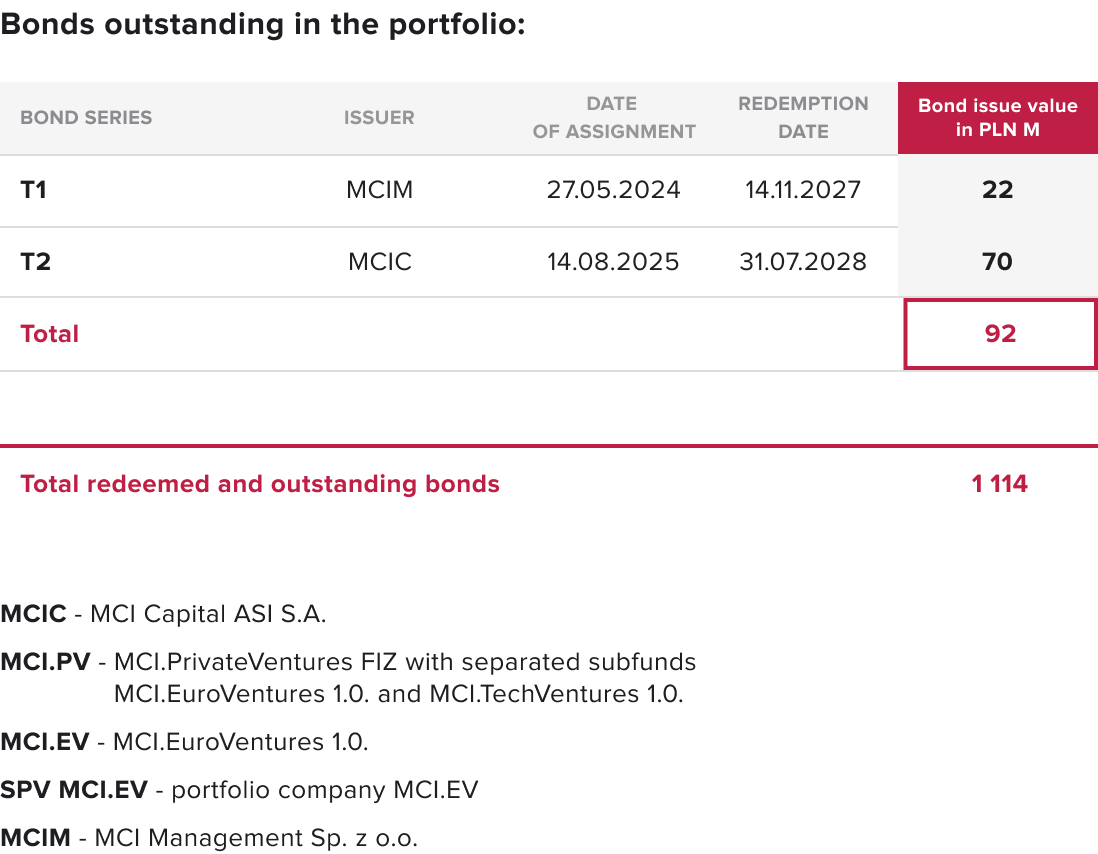

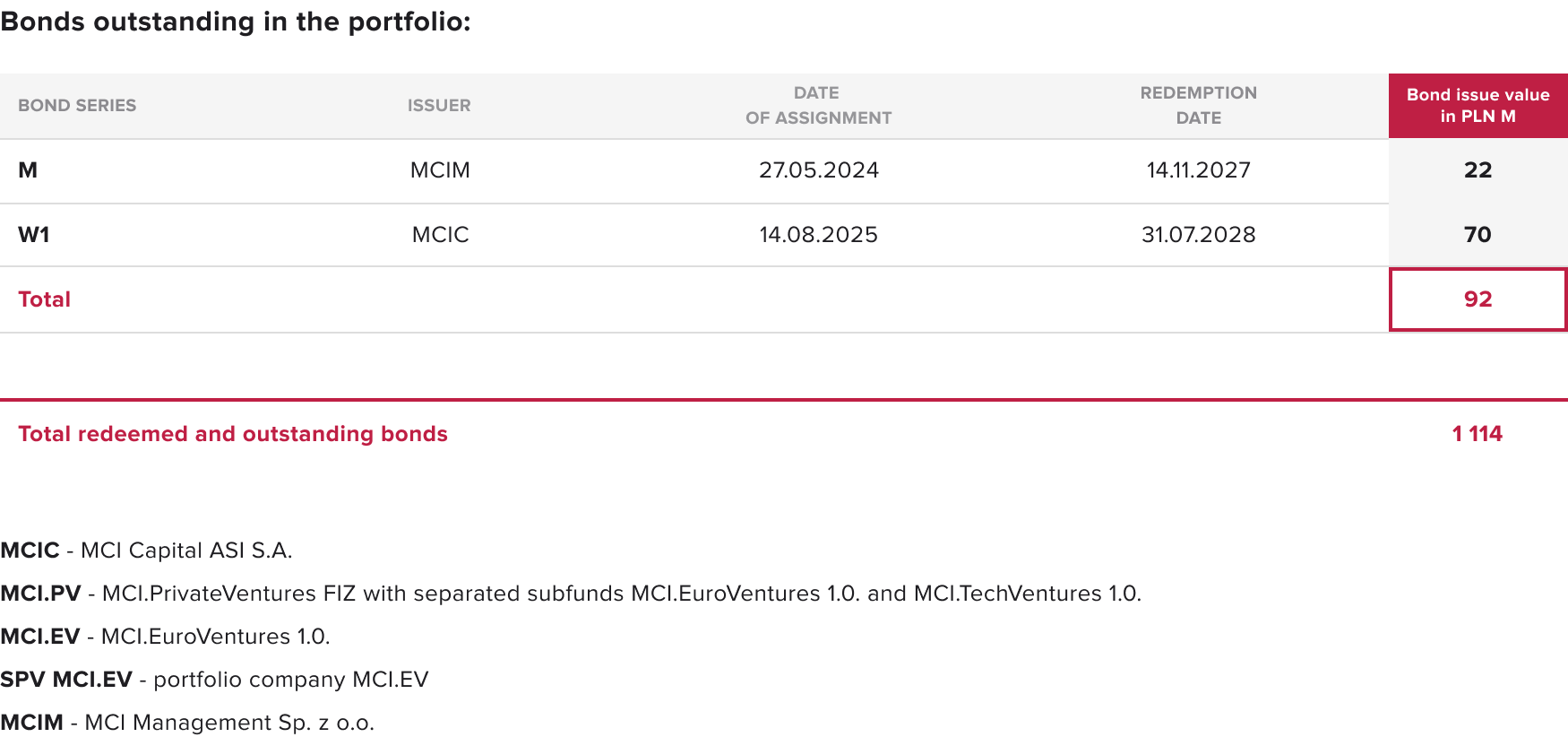

History of bond issues

since the beginning of its operations, the MCI Group has issued bonds to institutional and retail investors with a total nominal value of PLN 1,114 million, of which PLN 1,023 million was redeemed on or before maturity, and PLN 92 million is currently in the Group’s portfolio.

1,114 PLN M

bonds issued

1,023 PLN M

bonds redeemed

92 PLN M

bonds in the portfolio

MCI success stories

Throughout our history, we can boast of unique investment exits that help us build our brand and trust among investors:

-

Portfolio

companybuyer

transaction type

mPLN

CoC

IRR

-

Strategic sale

-

Strategic sale

-

Private Equity

143,9

2,8x

20%

-

Strategic sale

145,6

1,7x

21%

-

Strategic sale

511,1

2,8x

30%

-

IPO WSE

35

2,7x

19%

-

Strategic sale

6,8

-

Strategic sale

126,4

2,8x

20%

-

SPO Istambul Stock Exchange

133,3

1,3x

7%

-

Strategic sale

29,1

1,8x

8%

-

Private Equity

323,1

4,1x

104%

-

Strategic sale

276,3

2,3x

12,1%

-

Strategic sale

261,2

3,1x

38%

-

Strategic sale

163,1

3,7x

62%

-

Recap

36,6

15,6x

37%

-

IPO WSE

163

2,7x

54%

-

Private Equity

270,3

5,0x

41%

-

Strategic sale

23,1

3,7x

327%

-

Strategic sale

21,5

4,8x

68%

-

IPO Frankfurt Stock Exchange

34,1

-

SPO WSE

168,5

1,1x

18%

-

Strategic sale

161,6

4,1x

174%

-

IPO WSE

28,1

4,2x

60%

-

IPO WSE

21,4

7,8x

105%

-

MBO

11,3

2,4x

17%

-

Strategic sale

18,7

4,7x

31%

-

Strategic sale

4,5

2,3x

21%